single life annuity meaning

A single life annuity provides you with a regular guaranteed income until your death upon which the policy ends. An annuity is an insurance product that allows you to swap your pension savings for a guaranteed regular income that will last for the rest of your life.

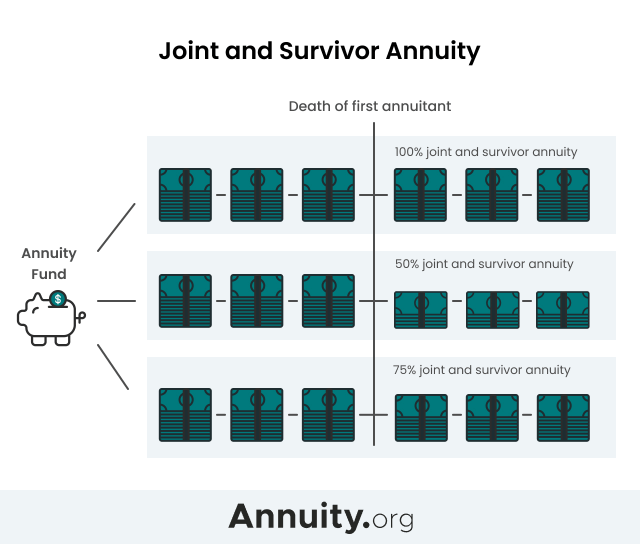

Joint And Survivor Annuity The Benefits And Disadvantages

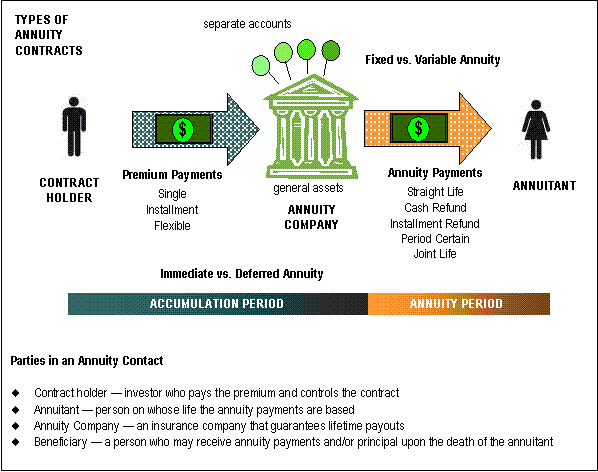

Annuitants pay premiums or make a lump-sum payment to secure a life.

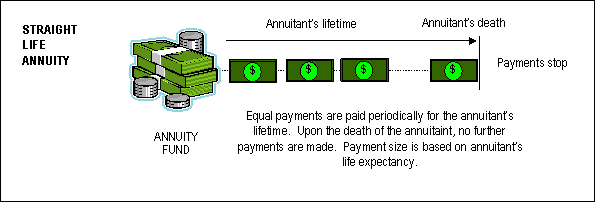

. A single life annuity is an annuity that provides an income as long as the annuitant is living. A single life annuity or straight life annuity can provide a retiree with a monthly payment for as long as he or she lives. An annuity can be a single life annuity or a joint life annuity where the payments are guaranteed until the death of the second annuitant.

If your spouse has enough retirement income it would pay you to select a single life annuity. A life annuity is a financial product that features a predetermined periodic payout amount until the death of the annuitant. A single life annuity is a contract between a financial institution and one specific person.

When the annuitant dies the contract ceases unless it contains a guarantee period. People who have serious health problems should be offered a higher rate than someone whos likely to live for many years. When you opt for a monthly annuity in retirement you have two choices.

What Is a Single Life Annuity. Life insurance A single life annuity is an annuity where only one life is covered. It could be a suitable option for those without a spouse or partner or in the situation of a partner having sufficient pension arrangements of their own or a shorter life expectancy.

An annuity covering one person. In contrast to a shared life payment this will give money to domestic partners or extra annuitants if the annuity holder dies. Unlike a deferred annuity an immediate annuity skips the accumulation phase and begins paying out income either immediately or within a year after you have purchased it with a single lump-sum payment.

The normal form of benefit is typically a single life annuity. When the annuity holder dies the payments stop. Dont settle for second best on your pension.

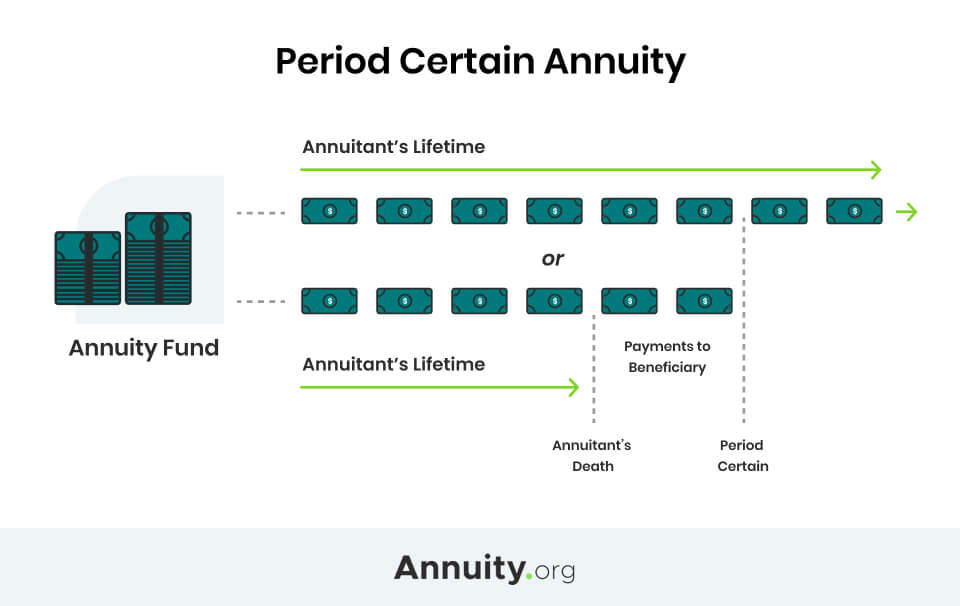

A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die. Single-life payout is one of two payout options an. Tim Grant One way to guarantee you will not outlive your savings is with an annuity.

A single life annuity is a specific type of annuity product and defines a way to structure your annuity payments. A straight life annuity provides payments until death while a life annuity with a guaranteed period provides payments until death or continues payments to a beneficiary for a guaranteed term such. A single life annuity guarantees a lifetime income for you alone.

A single life annuity is a pension plan that pays an income to an individual over the course of their lives rather than the traditional pension plan that would pay out to heirs or beneficiaries after death. To get payments that last for the life of just one person - you - or payments that last for the lives of both you and your. What is a single annuity.

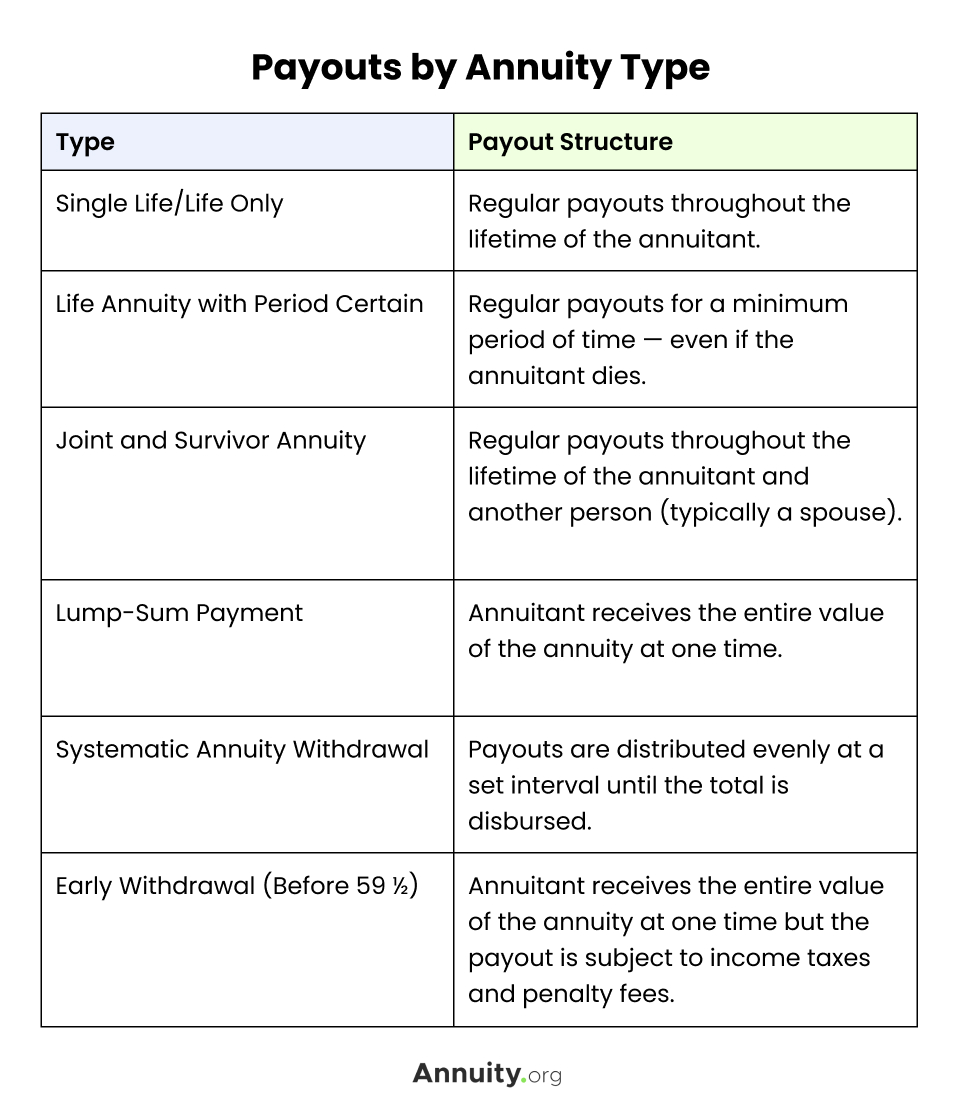

Single life annuities - pay a fixed amount at regular intervals during an annuitants life ending on his or her death. A Single Life Annuity also known as Straight Life Annuity or Life Annuity is a form of pension that is designed to provide assured payouts to a single person for the rest of the years. If the Participant dies after the date as of which benefits commence but before receiving 120 monthly payments monthly payments shall be made to.

Means a reduced monthly benefit compared to the Single Life Only Annuity payable to the Participant for his or her lifetime with a guarantee of 120 monthly payments. An annuity is a contract you make with an. How much you get is determined by the rate the annuity provider offers.

A A settlement option involving a single life annuity is the simplest and purest form of assuring a stream of income that cannot be outlived. After he or she dies a second annuitant receives a fixed amount at regular intervals. If you pass away during the guaranteed period the rest of the payments will go to your beneficiary.

SHOP AROUND TO ENSURE YOU GET THE BIGGEST RETURN FROM YOUR SAVINGS. If the annuitant outlives the 10 years of guaranteed payments then. It is regarded as ideal for retirees as it is the only income of any financial product that is fully guaranteed.

An annuity or pension that pays out to only one person is known as a single-life payout. A single life annuity is an annuity where only one life is covered. A series of payments are guaranteed during that individuals lifetime but the payments cease when the annuity holder aka an annuitant passes away.

Single life annuities are ideal for seniors. That is an annuity that makes monthly payments to you while youre alive and stops upon your death. Annuity payments are higher for single life annuities than they are for joint life annuities.

Who are concerned about out-living their savings who want to simplify investment decisions. Annuity payments can be received on a fixed or variable basis or a combination of both and can be paid as a single life annuity or joint and survivor annuity. It is a single annuity where the single person is the only beneficiary not a family member or spouse.

A SPIA is a contract between you and an insurance company designed for income purposes only. Understanding Single Life Annuity. Define Single Life Only Annuity with 120-Month Guarantee.

What Is a Single Premium Immediate Annuity SPIA. As well as not getting the best pension income one of the biggest mistakes many people make is to opt for a single-life annuity which means the pension stops immediately upon their death leaving loved ones without an income. Single life annuities are an attractive annuity payout option because they offer the highest monthly payouts of all the payout options.

If youre not married at retirement federal law requires that your benefit be paid as a single life annuity unless you elect a different payment option. Joint and survivor annuities - pay a fixed amount to the first annuitant at regular intervals for his or her life.

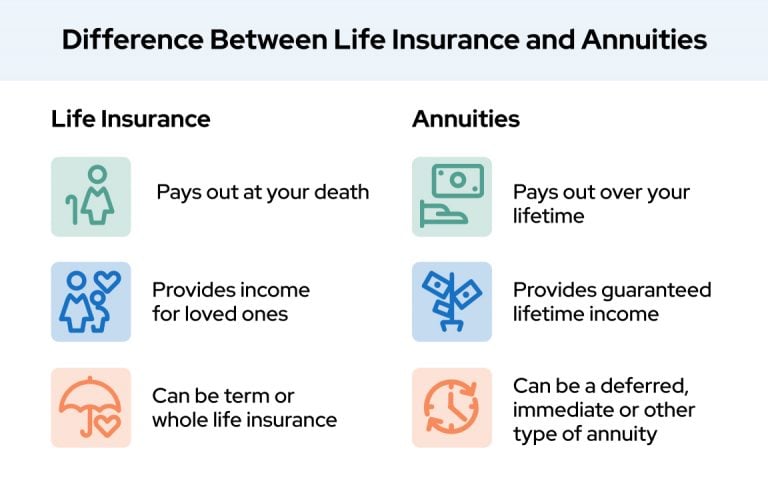

Annuity Vs Life Insurance Similar Contracts Different Goals

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

It S Fast Easy And Affordable Life Insurance Facts Insurance Life Insurance

Psers Pension Options Explained In 5 Minutes Or Less The Maximum Single Life Annuity Teachersretire

Life Insurance Vs Annuity How To Choose What S Right For You

Period Certain Annuity What It Is Benefits And Drawbacks

How Can You Maximize Your Pension Plan Sta Wealth Management Wealth Solutions How To Plan Wealth Management

Annuity Beneficiaries Inherited Annuities Death

Annuity Payout Options Immediate Vs Deferred Annuities

Reveal Why Single Premium Immediate Annuities Spias Work Annuity Transamerica Single Premium

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Single Life Annuity Due

Annuity Sales Pitches The Facts Behind The Most Popular One Sales Pitch Annuity Pitch

Psers Pension Options Explained In 5 Minutes Or Less The Maximum Single Life Annuity Teachersretire

Does An Annuity Plan Work For You Businesstoday

What Is A Single Life Annuity Definition And Payout Option

Straight Life Annuity For Retirement Is It Right For You Paradigm Life