venmo tax reporting for personal use 2022

A business cant use a personal account because it doesnt provide the necessary tax records. The main reason why businesses cant use Venmo personal is that it isnt permitted.

Making Money On Paypal Or Venmo The Irs May Be Tracking Your Payments Cnet

Venmo states that the personal account is for peer-to-peer payments and purchasing from authorized business profiles nothing more⁵.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KDDFV3EA2JBJFDL3KCMEYOZ3MY.jpg)

. Plus since customer information is visible with. If youre working on your 2021 taxes now you still have to report all your income but you wont be. Heres a breakdown of the new rule and what it means for your 2022 tax returns.

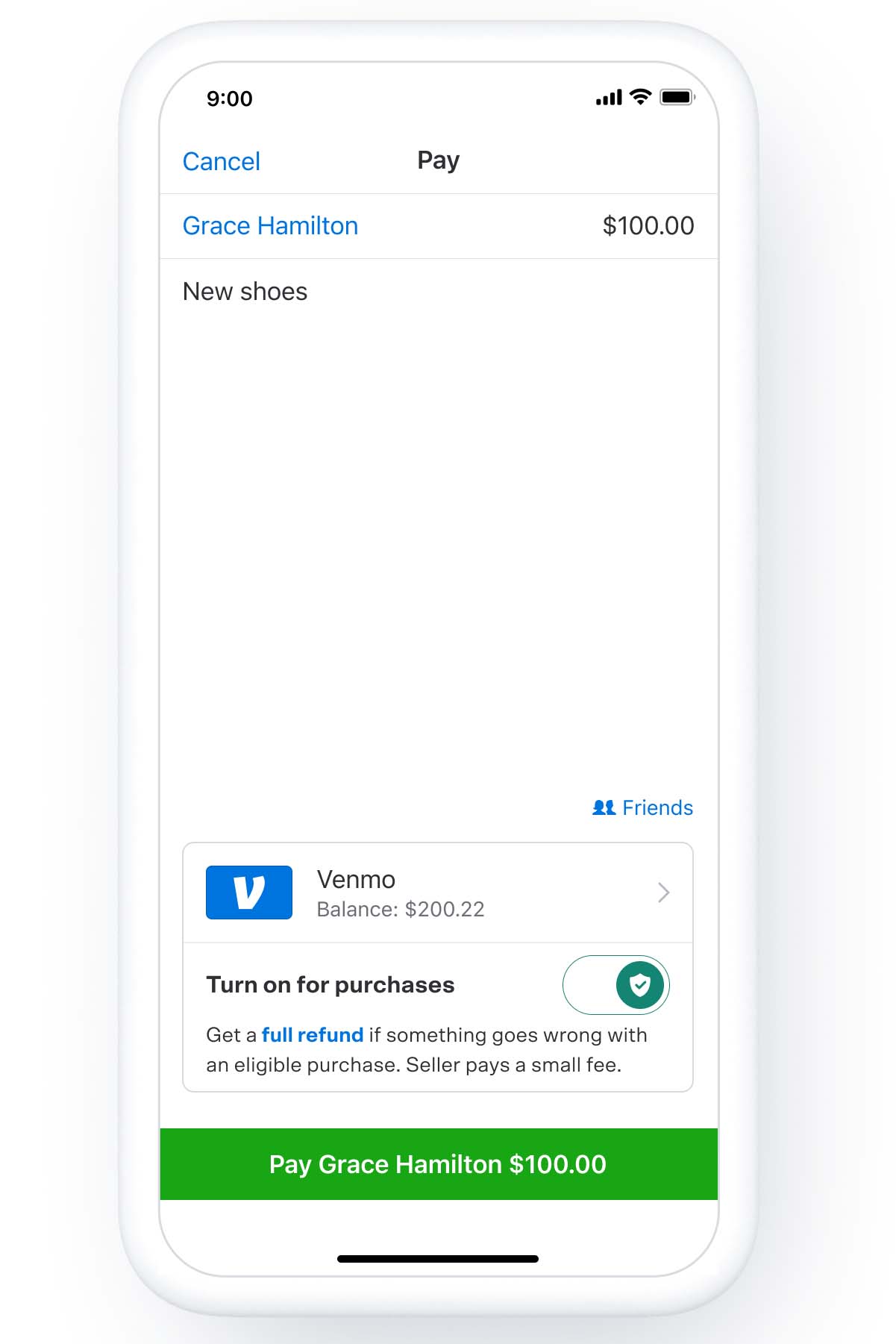

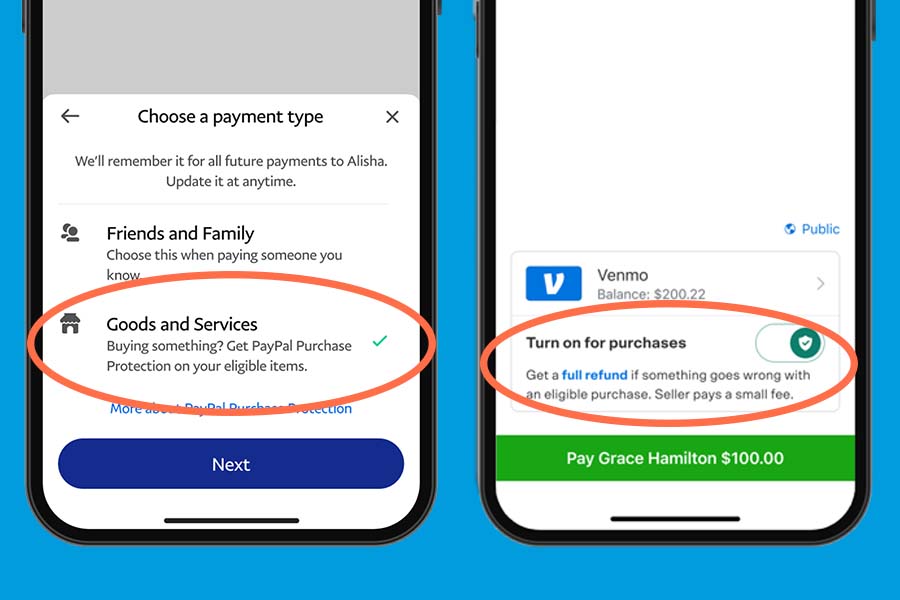

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Merchants Using Payment Apps Will See 2022 Tax Changes Infintech

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Pehal News

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KDDFV3EA2JBJFDL3KCMEYOZ3MY.jpg)

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes Kiro 7 News Seattle

Press Release New U S Tax Reporting Requirements Your Questions Answered

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca