georgia film tax credit 2020

The states growing film industry generated about 85 billion in economic impact during the last fiscal year. FAQ for General Business Credits.

Essential Guide Georgia Film Tax Credits Wrapbook

ATLANTA Georgias effective but expensive film tax credit came up for discussion Thursday during a legislative hearing on deep budget cuts lawmakers will face when they resume the 2020 General Assembly session next month.

. A Base Certification Application may be submitted within 90 days of the start of principal photography. Select tax account inquiry business tax credits. The state agencies in charge of Georgias film tax credit have strengthened oversight of the program by fully or partially addressing all shortcomings identified in a 2020 audit a follow-up.

If the GEP Uplift has been awarded a. The bill removes the right of recapture by the state of any tax credits that undertake the new audit process and clarifies many related rules. On August 4 2020 Georgia Governor Brian Kemp signed House Bill 1037 HB 1037 which outlines several changes including a new application process mandatory audits timing of credit issuance and eligibility modifications.

Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any. Federal Tax Changes Need Help. How-to Videos and Instructions for Tax Credits.

Tax Credit Forms You may also need. The economic impact of film and TV production in Georgia has soared from 93 million in direct spending in fiscal 2007 the year before lawmakers adopted the film tax credit to a peak of 29 billion in fiscal 2019 before dipping to 22 billion when the coronavirus pandemic ground production to a halt during the fourth quarter of the last. The film tax credit is a good deal for Georgia and its taxpayers said Kelsey.

Brian Kemp signed House Bill 1037 which requires mandatory audits of film tax credits. The General Assembly passed legislation two years ago requiring all film productions located in Georgia to undergo. Even amid the pandemic the.

Once the base investment requirement has been met the film tax credit can be claimed when a Georgia tax return is filed. These audits can be conducted by third-party CPAs who meet certain criteria the bill says. ATLANTA The state agencies in charge of Georgias film tax credit have strengthened oversight of the program by fully or partially addressing all shortcomings identified in a 2020 audit a.

The Georgia film tax credit has worked as intended and built an industry that spends nearly 3 billion per year in the state and employs tens of thousands of Georgians in high-paying jobs the Georgia Screen Entertainment Coalition said today in response to the state of Georgias audit. Since the program was introduced in 2008 Georgia has grown from a state that hosted a smattering of productions into a full-fledged Hollywood of the South. The state agencies in charge of Georgias film tax credit have strengthened oversight of the program by fully or partially addressing all shortcomings identified in a 2020 audit a follow-up review has concluded.

Certification for live action projects will be through the Georgia Film Office. 1 State Certified Production. Income Tax Letter Rulings Policies and Regulations.

Send an email for tax credit questions. Prior to claiming any Film Tax Credit each new film video television or Interactive Entertainment project must be certified as meeting the guidelines and the intent of the Act. The credit includes various income and payroll credits but recently passed legislation makes several important changes.

The 2020 audit concluded the agency had broadly interpreted the laws provisions approving projects that could be considered. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. 159-1-1-03 Film Tax Credit Certification.

ATLANTA The state agencies in charge of Georgias film tax credit have strengthened oversight of the program by fully or partially addressing all shortcomings identified in a 2020 audit a follow-up review has concluded. Help using the Georgia Tax Center. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures.

A Project Certification Requirement.

Georgia Film Records Blockbuster Year In Fy 2021

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Essential Guide Georgia Film Tax Credits Wrapbook

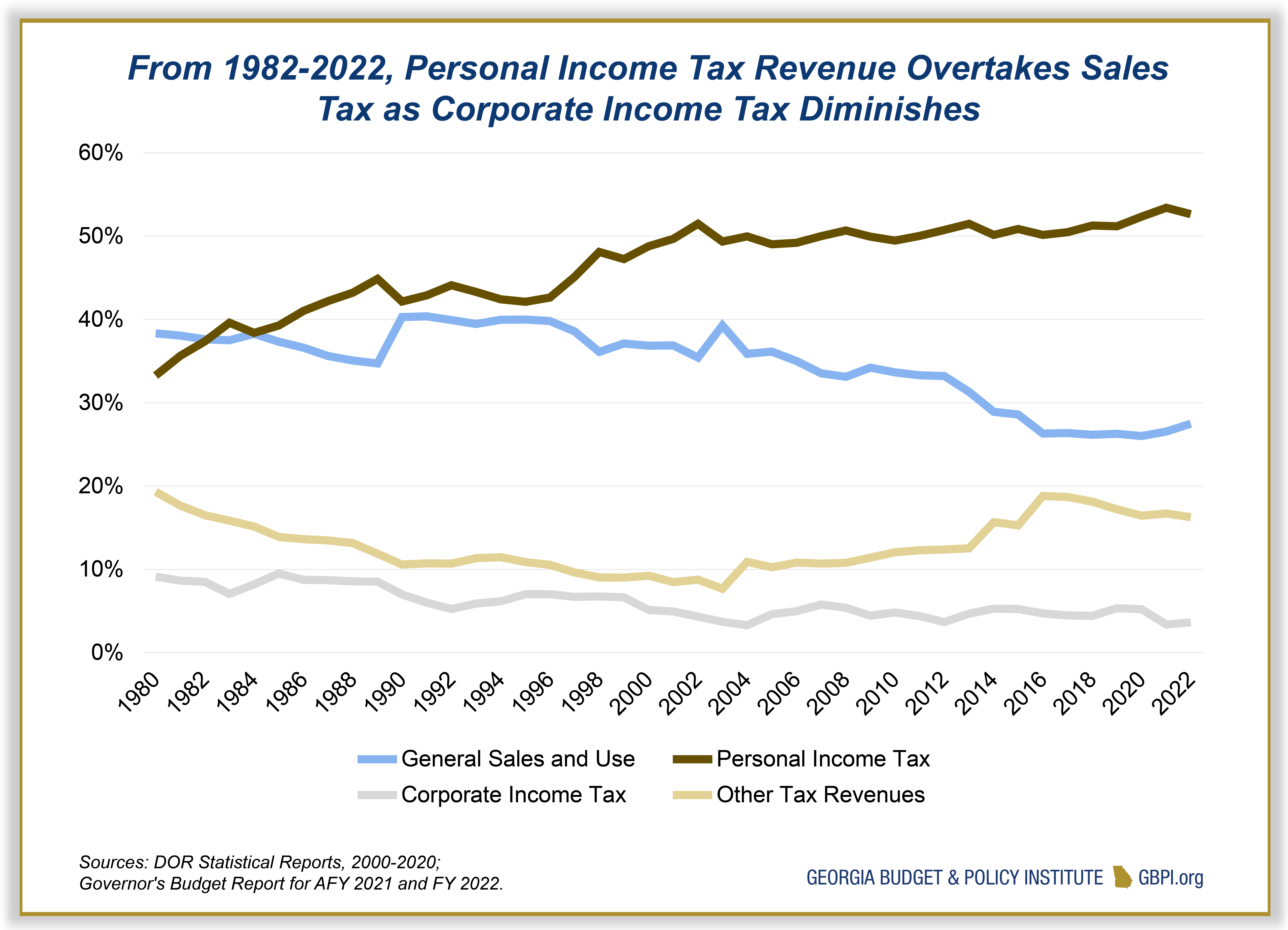

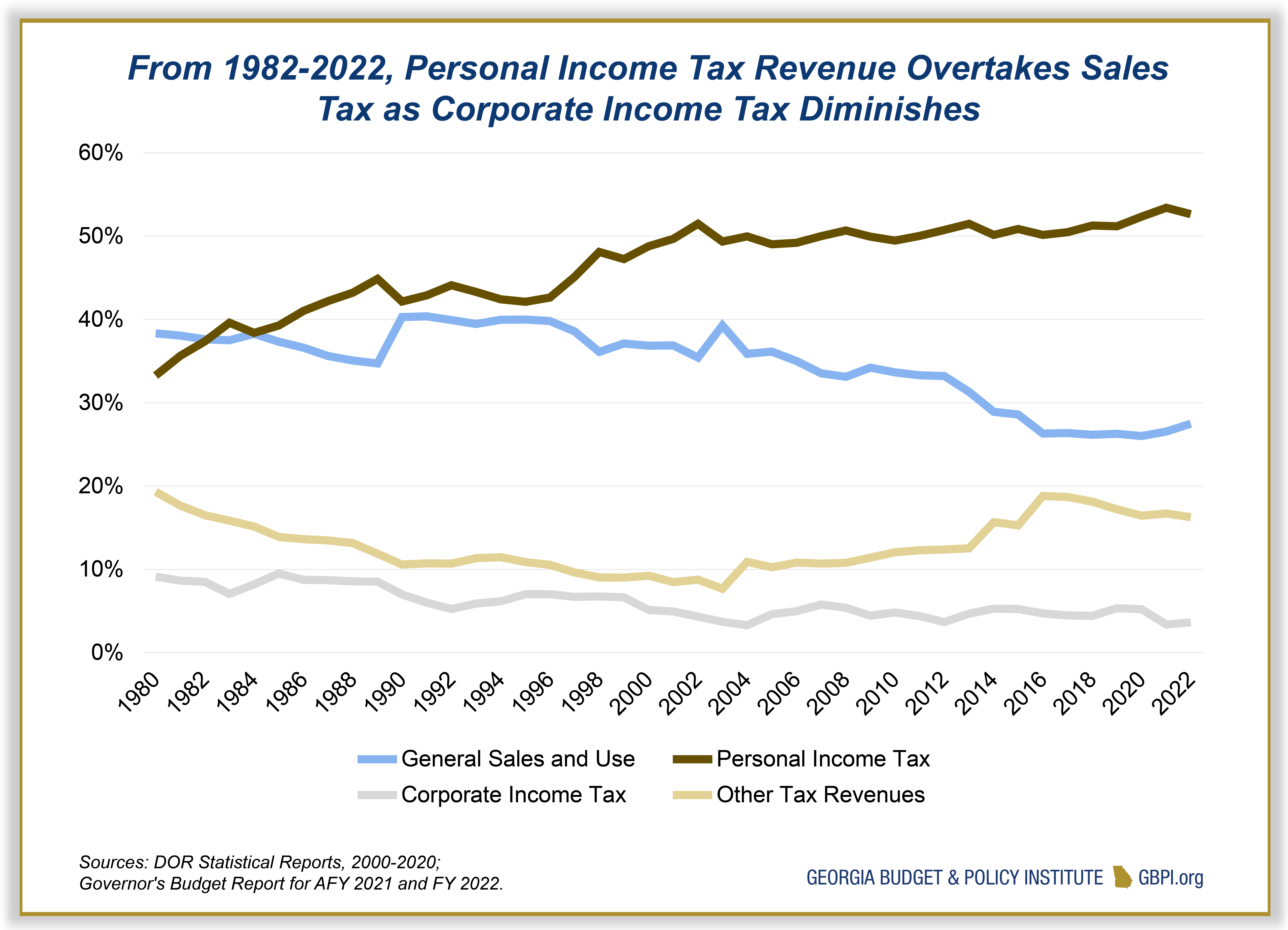

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Film And Tv Spending In Georgia Hits 4 4b The Hollywood Reporter

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Opinion Ga S Film Tax Credits Are Big Budget Flop

Study Georgia Tied As Third Biggest Home For Scripted Tv Production Behind California New York

/cdn.vox-cdn.com/uploads/chorus_asset/file/19161249/Ringer_HollywoodGeorgia.jpg)

Can Hollywood Change Georgia Or Has It Already The Ringer

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements